Here's the question that gives most founders cold sweats:

"How much runway do you have?"

If you can't answer that in 30 seconds without opening five different tools and doing mental math, you have a financial visibility problem.

And that problem isn't just about inconvenience—it's about confidence.

During my 15 years building businesses across China, I learned something crucial about financial management: The founders who sleep well at night know their numbers cold. The founders who wake up anxious are the ones flying blind.

The Real Cost of Financial Confusion

Most founders think financial chaos is just about inefficiency. It's not.

When you can't trust your financial data, three things happen:

You make conservative decisions out of fear. When you're not sure how much runway you have, you default to worst-case planning. You delay hiring, skip marketing spend, and pass on growth opportunities.

You lose credibility with investors. Nothing kills investor confidence faster than a founder who can't give accurate financial updates or takes three days to answer basic questions.

You develop that Sunday night financial anxiety. You know the feeling—that dread when you realise you need to prepare an investor update and your financial data is scattered across seven different systems.

I've seen promising Chinese joint ventures collapse not because they ran out of money, but because the founders lost confidence in their ability to manage money effectively.

Where Financial Clarity Actually Breaks Down

The problem isn't that founders are bad with money. The problem is that early-stage financial systems are designed for confusion:

Your revenue data lives in your CRM, your expenses in three different credit card systems, your cash flow in spreadsheets, and your projections in your head.

When my twins were born and I had maybe 2-3 hours daily to work, I realised something important: Every minute spent hunting for financial information is a minute not spent making financial decisions.

Here's what actually happens to most founders:

You spend Monday morning trying to figure out your burn rate. You spend Tuesday reconciling expenses from different systems. By Wednesday, you're building financial projections based on data you're not sure you trust.

The worst part? You're making critical decisions—hiring, spending, fundraising—based on financial gut feelings instead of financial facts.

What Actually Creates Financial Confidence

After years of managing complex financial structures across multiple currencies and regulatory environments, here's what I've learned works:

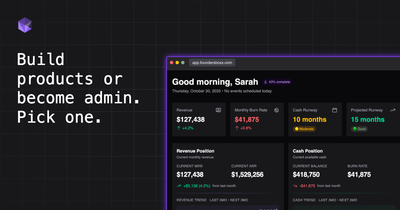

Single source of truth for cash. You need to know your bank balance, burn rate, and runway without thinking. Not weekly—daily.

Automated financial reporting. Your monthly financial picture should update itself. Manual financial reports are not just time-consuming—they're unreliable.

Scenario planning that makes sense. Forget complex financial models. You need simple what-if scenarios: What happens if we hire two people? What happens if this deal closes? What happens if it doesn't?

Regular financial check-ins. In China, successful business partnerships always included weekly financial reviews. Not because anyone didn't trust the numbers, but because everyone wanted to make decisions based on current reality.

The Three-Number Rule

Here's something I learned managing businesses across volatile Chinese markets: You need to know three numbers by heart at any time.

- Your runway in months. How long can you operate at current burn before you need more money?

- Your monthly burn rate. What does it actually cost to keep your company running each month?

- Your cash balance right now. Not last week's balance. Today's balance.

If you can't answer these three questions immediately, you don't have financial clarity—you have financial theater.

Building Financial Systems That Work Under Pressure

When you're managing financial operations under stress—whether it's fundraising pressure, rapid growth, or market uncertainty—your systems need to be bulletproof.

Here's what works:

Connect your financial tools. Your banking, expense management, and accounting systems should talk to each other automatically. Manual data entry is where financial errors breed.

Weekly financial reviews, not monthly. By the time you discover a financial problem in your monthly review, you've lost weeks of response time.

Simple cash flow forecasting. You don't need complex models. You need clear visibility into when money comes in and when money goes out.

Investor-ready reporting. Your financial reports should be accurate enough and clean enough that you could send them to investors without embarrassment.

The Surgical Approach to Financial Fixes

Don't try to fix everything at once. Pick your biggest financial pain point and solve it properly:

If you can't track burn rate accurately: Consolidate your expense tracking and automate your cash flow reporting.

If financial projections stress you out: Build simple scenario models that you can update weekly, not complex forecasts you update quarterly.

If investor updates take forever: Create automated financial dashboards that pull from your actual systems instead of manual spreadsheets.

If you're not sure about your runway: Set up automated cash flow tracking that accounts for both current burn and planned expenses.

The goal isn't financial perfection. It's financial confidence.

What Happens When You Get This Right

When you fix your financial visibility, something interesting happens beyond just saving time.

You start making growth decisions instead of survival decisions. You can evaluate opportunities based on data instead of fear. You can have investor conversations about growth instead of apologizing for unclear numbers.

Most importantly, you sleep better. Because you know exactly where you stand financially, and you trust the systems that got you that information.

The most successful business leaders I worked with in China had a saying: "Clear books, clear mind." When you can trust your financial data, you can focus on building instead of worrying.

What financial question keeps you up at night because you're not sure you can answer it accurately?